Categories

The Little Disaster – Structure for Success

Having the right structure can be the key difference for financial independence. Regardless of whether you are running your business or selling it, structure is everything. The New Financial Year is a great time to be looking at your business structure. The small business tax laws in Australia are very flexible and give businesses a chance to restructure and get themselves right.

We recently encountered a business structure that was so bad that we nicknamed it “The Little Disaster.”

The Little Disaster

For the sake of this example, we will call this client Jack Dawson. (Not his real name)

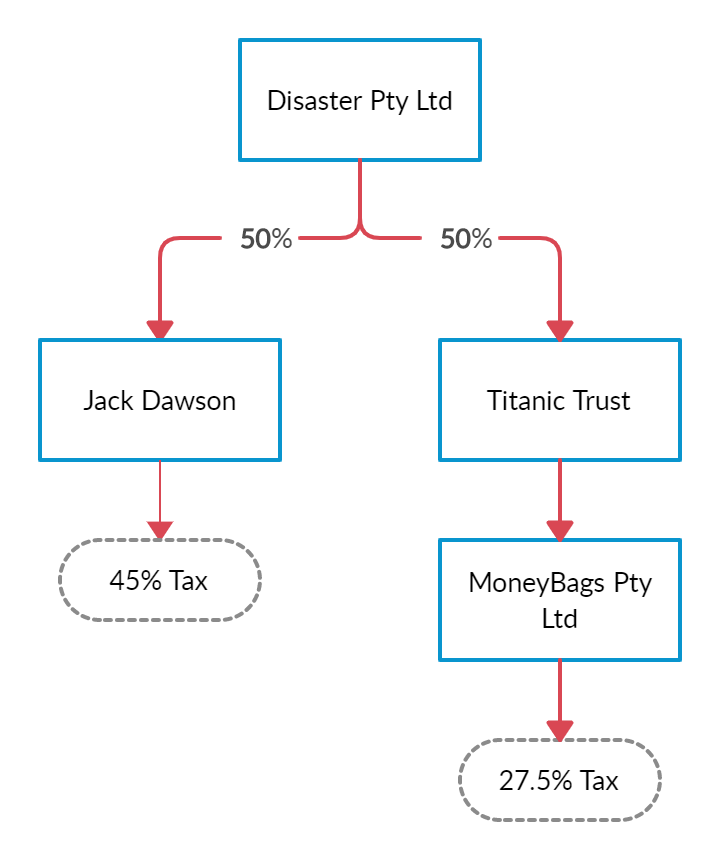

Jack had a family business under a trading company. This was the first mistake, but it gets worse. Out of 100 shares in the company, 50% of the shares were in Jack Dawson’s name, and the other 50% of the shares are in a discretionary trust.

What happens when Jack wants to get some money out for his investments?

The only way for Jack to receive funds from the business is through a dividend. But remember, only 50% of the shares are in Jack’s name so the dividend is divided 50/50 between Jack and the Titanic Trust.

Out of the $100k paid out via a dividend from the company, $50k goes to Jack. But now tax comes into play. Jack has a good growing business, so he will be paying 40-45% tax on what he’s received.

The other 50%, flows through his discretionary trust and down to Money Bags Pty Ltd. However Money Bags Pty Ltd has a lower tax rate of 27.5%.

This is a structuring disaster.

Structure for Success

After speaking with Jack Dawson, we were able to help him restructure his business into a winner. The new structure may seem much more complicated, but when it comes to trusts, complexity is your friend.

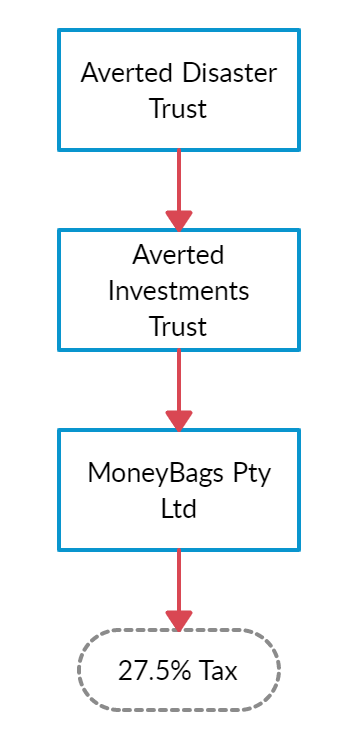

In the good structure, the family is running their business under a discretionary trust, which is called the Averted Disaster Trust. Whenever the Averted Disaster Trust makes some excess cash, the excess cash flows into The Averted Investments Trust.

The Averted Investments Trust can then purchase property, shares, et cetera. The investments in the Averted Investments Trust’s are asset-protected against the business. (This is why you need a second trust.)

Money from The Averted Investments Trust then flows into Moneybags Proprietary Limited at the tax rate of 27.5%. This is where Jack can access funds for investment.

How’s your structure looking? Do you have a Little Disaster on your hands? If you need a restructure, talk to the right people. Get your structure right with Paris Financial, the structure and small business champions.